55+ what percent of your mortgage should be of your income

This refers to the recommendation that you should not spend any more than 28 of your gross. Web The 503020 rule for budgeting is fairly straightforward.

:max_bytes(150000):strip_icc()/why-retire-at-55-2388841-final-7bf4aaf54bf645edb08167c28468f077.png)

Before You Retire At 55 Consider These 3 Things

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

. Calculate Your Payment with 0 Down. Web The 35 45 Model. Apply Now With Quicken Loans.

Lets take a look at a few calculations you can use. With this method you spend. With a 30-year mortgage.

This means that if you want to keep. Compare More Than Just Rates. Web What percentage of income should go to a mortgage.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web Some experts have suggested something called the 2836 rule. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Every borrowers situation is different but there are at least two schools of thought on how much of your. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. To afford a 400000 house borrowers need 55600 in cash to put 10 percent down.

John in the above example makes. Web Lenders often recommend that a monthly mortgage payment should not represent more than 28 of an individuals gross income. Web What income is required for a 400k mortgage.

Web The 28 rule. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Ad Compare Mortgage Options Get Quotes. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income. Get Started Now With Quicken Loans.

To find your maximum mortgage. Ad Veterans Use This Powerful VA Loan Benefit For Your Next Home. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken.

30 of income on wants. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. The 28 rule specifies that your mortgage payment shouldnt be more than 28 of your monthly pre-tax income.

Web The calculation depends on your personal income other financial goals and debts. Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage. Mary has an average.

Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. 50 of income on necessities or needs. But some borrowers should set their personal.

Compare Mortgage Options Calculate Payments. Web Most lenders must follow strict policies that limit a mortgage payment to a lower percentage that commonly being 28 percent.

What Percentage Of Income Should Go To A Mortgage Bankrate

127 S Avenue 55 Los Angeles Ca 90042 Mls Dw23026438 Zillow

8 Ways To Buy A Home In Atlanta With Little Or No Money Down Knowatlanta Atlanta S Relocation Guide

Mortgages For Over 50s Homeowners Alliance

How Big Of A Mortgage Should I Get Managing Debt Wisely

Market Square Better Housing Coalition

What Percentage Of Your Income To Spend On A Mortgage

Pros And Cons Of 55 Communities Rocket Mortgage

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Of Your Income You Should Spend On Housing

What Percentage Of Income Should Go To Mortgage

Buying A Home In A 55 Community Bankrate

Retirement And 55 Communities In Little River Sc

How Much House Can You Afford Calculator Cnet Cnet

Percentage Of Income To Spend On Your Mortgage Moneytips

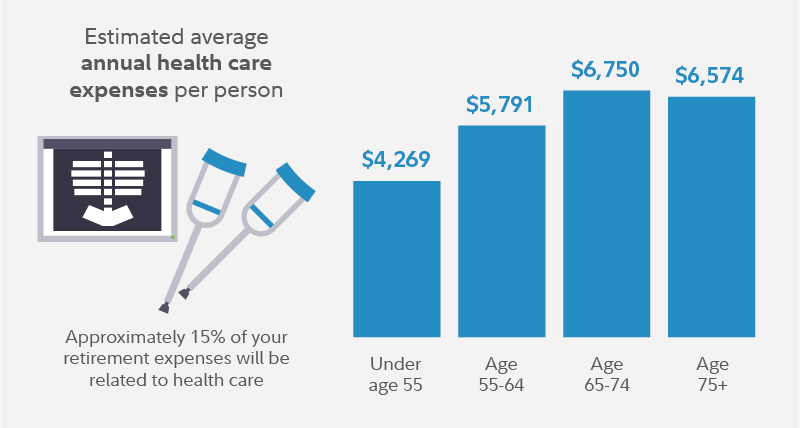

How Much Will You Spend In Retirement Fidelity

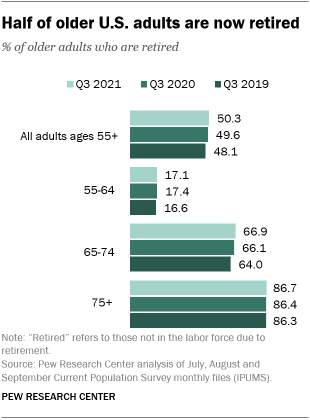

Amid The Pandemic A Rising Share Of Older U S Adults Are Now Retired Pew Research Center