How much can i borrow if i earn 90000

But if this worker or the workers spouse are younger than full retirement age and receiving benefits and earn too much the benefits will be reduced. Use this free tool to see your minimum required income.

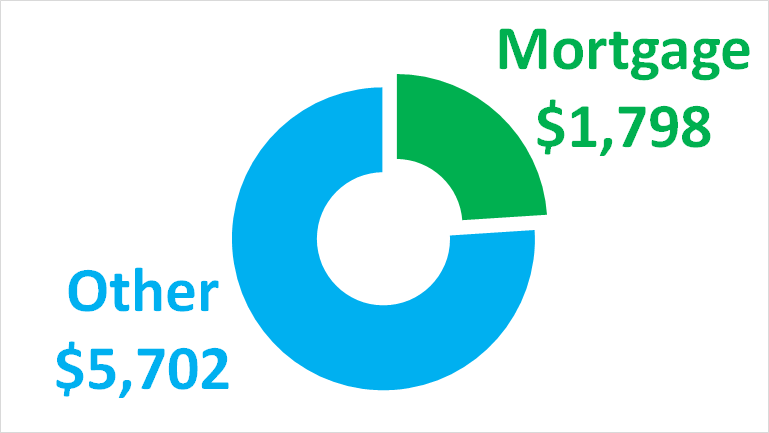

10 Things That Helped Us Pay Off Our 90 000 Mortgage In 5 Years Thrifty Frugal Mom

If you are outside Canada and the United States call 613-940-8495We only accept collect calls made through telephone.

. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairmentFor more information go to Order alternate formats for persons with disabilites or call 1-800-959-8281. For a family of three 60000 - 180000. We welcome your comments about this publication and your suggestions for future editions.

Non-homeowners including first-time buyers and those who previously owned a home who earn 80000 a year or less thresholds are up to 90000 in London. When you really drill down the numbers its probably unrealistic to expect to earn your entire living off one BB property. California where leaders once envisioned free higher education accounts for.

To learn more about the Help to Buy shared ownership scheme visit. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income. They are as much about a fundamental feeling of safety security settlement and identity.

You can use the above calculator to estimate how much you can borrow based on your salary. You can deduct 100 of your meal expenses if the meals are food and beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023. Homes are more than just a roof over ones head.

A masters degree can often guarantee higher earnings than a bachelors degree but it can also come with more student loan debt. Paying for this ticket often requires student loans. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Hi Iza Thanks for your inquiry and for visiting our page. You can continue to deduct 50 of the cost of business meals if you or your employee are present and the food or beverages arent considered lavish or extravagant. Approximately 60 of those who complete graduate school have.

When you have supplies on hand for your guests to use or borrow you will significantly improve their experience. In Sydney an apartment in the city center costs an average of 1090 per square foot compared to about 695 per square foot in the Sydney suburbs. Unsure if you can afford your dream home.

Find out How Much You Can Borrow for a Mortgage using our Calculator. For a single individual a middle-class income ranges from 30000 - 90000 per year. First Floor Flat Gilloch Hall Back Street Bridge of Earn PH2.

Its about homes for people and for business. Take a moment and think about any ways you could quickly earn some more money with your employer because they already trust you and they can pay you quickly. NW IR-6526 Washington DC 20224.

Foreigners can borrow up to 70 of the purchase price of their homes and Americans are eligible to borrow in Australia. The biggest cities though are much more. 6 to 30 characters long.

ASCII characters only characters found on a standard US keyboard. Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage. So if you earn 60000 per.

For a couple it starts at 42430 up to 127300. And four 67100. This is a general estimate not an actual amount.

If you reside in London your annual household income must be 90000 or less. They will also factor in your outgoings and offset this against the amount you earn. How Much Income do I Need to Earn to Buy a Home.

Earn 25 bonus points on base points you earn in a billing cycle when you maintain a Virtual Wallet Virtial Wallet Student Virtual Wallet Performance Spend Virtual Wallet Performance Select Performance or Performance Select checking account 90000 points per year with 25 bonus Redeem your points for a variety of rewards. Across the US 45 million people owe a combined 175 trillion. How to borrow from home equity.

Your AIP is also a formal document that you can use when youre considering on making an offer for a property. Flats Houses For Sale in Bridge Of Earn - Find properties with Rightmove - the UKs largest selection of properties. 90000 124 29 1965 4800 725.

2 bedroom flat for sale. The federal governments ability to repay Social Security is based on its power to tax and borrow and the commitment of Congress to meet its. Homeowner couples can have assets of up to 405000 non-homeowners 621500.

To qualify for the maximum amount single homeowners can have assets of up to 270500 while non-homeowners can have up to 487000. We also factored in how many people with each major went on to earn a higher degree such as a masters degree or doctorate. It will depend on your Salary Affordability Credit score.

Singles can have income of up to 180 a fortnight while couples can earn 320 a fortnight combined and still receive a full Age Pension. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Must contain at least 4 different symbols.

In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Lets use an example of a six-room property with pricing at 90 per night. Check your affordability and learn how much you can borrow based on your monthly income and outgoings.

A mortgage calculator is a great way to get a quick idea of how much you may be able to borrow but its not as personalised as an Agreement in Principle. Pros Cons Fee waived for first year. Which means the homeowner must finance 90000.

How much mortgage can you borrow on your salary. Buyers typically engage a. The Elders Real Estate Kempsey team knows that its business is about much more than structure space and location.

Can i borrow 90000 for personal loan. Whilst the typical borrower can expect to be offered between 4 and 45 times their salary. You may want to consider.

Youll need to have enough savings to cover a 5 deposit of the share youre buying and to cover moving costs stamp duty solicitors fees etc. Regularly ranked one of the worlds most unaffordable cities Aucklands prices skyrocketed by as much as 30 per cent during the Covid-19 pandemic hitting a record high 13m median sales price. Nikkiangco October 17 2018.

If you invite a friend you can earn at least 6000 bonus membership rewards points if they are approved up to 90000 points a year. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

Mortgage Required Income Calculator Capital Bank

Pin On Weekend Escape

What It Takes To Be Free Foroux Darius 9789083023823 Amazon Com Books

Pin On Homemade Tools

How Much House Can I Afford Calculator Money

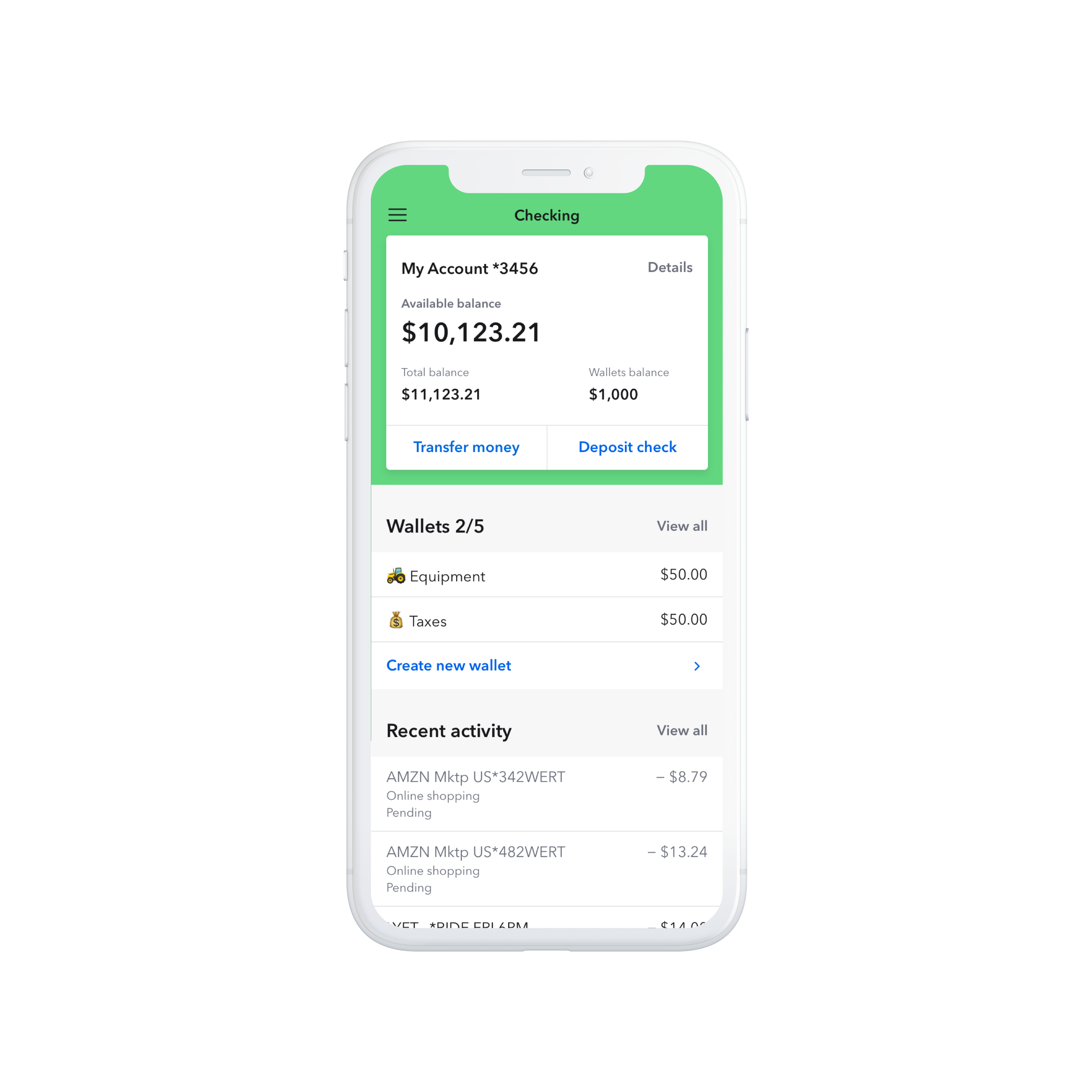

Kabbage Launches Full Service Business Checking Accounts Designed And Built For Small Businesses Kabbage Newsroom

Actg Ch 7 Flashcards Quizlet

Burns Nclex Questions Reviewer 100 Items Nclex Burns Nursing Nurse

Mortgage Affordability Calculator Trulia

I Make 90 000 A Year How Much House Can I Afford Bundle

Free Forex Signals Forex Signals Forex Chart

90 000 After Tax 2021 Income Tax Uk

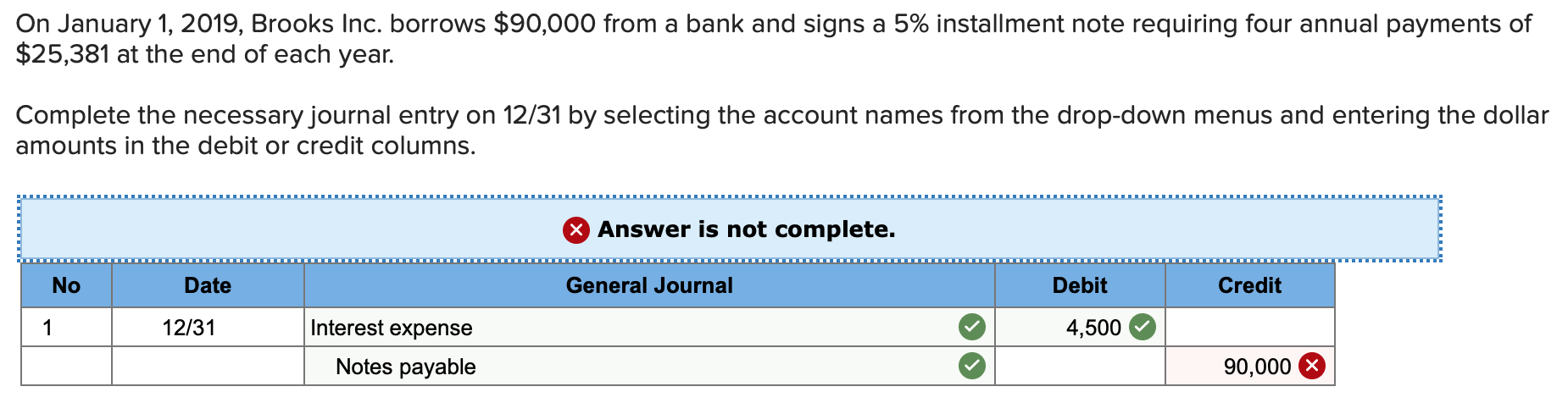

Solved On January 1 2019 Brooks Inc Borrows 90 000 From Chegg Com

Mortgage Required Income Calculator Capital Bank

Why Someone Making 90 000 Doesn T Feel Rich

Bts Jungkook Goes Viral For His Cool Guy Look At The Un His Rs 90 000 Checkered Pants Take The Cake

Mortgage Required Income Calculator Capital Bank